Achieve Financial Independence

Do you know how much income you need your assets to generate once you retire?

Evaluating Your Retirement Income

Although many individuals nearing retirement have at least one 401(k), IRA or defined benefit plan, rarely will those income sources meet the full range of retirement expenses.

By working with us, we can help determine how much you will need to withdraw from your retirement portfolio to live comfortably in retirement. The less you withdraw, the better your chance your assets can generate income through the duration of your retirement. The general rule of thumb is a maximum withdrawal of 3% to 4% per year, but you may need to withdraw more or less depending on your specific circumstances.

You may need to adjust your rate of withdrawal based on future market performance. The sustainable rate of withdrawal is historical and will fluctuate. If your rate of withdrawal is greater than the growth of your assets, you may exhaust your principal.

Making a Plan

Your goal should be to build up enough assets to provide adequate income to meet your needs throughout retirement – accounting for factors like increased longevity, healthcare costs and inflation. To accomplish this goal, you need a plan.

How Much Money Will You Need?

To maintain your standard of living, a general rule of thumb suggests your annual retirement income should equal approximately 80% of your income the year you retire. So, if you determine you’ll earn $100,000 the year you retire, you’ll need to save enough to provide $80,000 for each year you are retired.

Healthcare Considerations

Many retirees underestimate how much they’ll need to cover healthcare expenses. In fact, a Center for Retirement Research study recently estimated out-of-pocket costs for a healthy 65-year-old couple to be $260,000 to $570,000 for their entire retirement. Income from investments and Social Security can go toward paying ongoing medical costs, such as Medicare premiums, deductibles and copays, but as healthcare costs continue to rise, this could place a significant strain on your retirement. We can work together to anticipate your healthcare expenses in retirement and account for them within your overall retirement income plan.

Another risk-management option is long-term care insurance, which covers a range of nursing, social and rehabilitative services for people who need ongoing assistance due to a chronic illness or disability. While you can’t know for sure if you’ll need long-term care or for how long, a comprehensive policy can help you plan for the unexpected.

Some people choose a policy to help:

- Protect assets

- Add options for quality care

- Relieve family and friends from the stress of providing care

- Preserve their independence, dignity and financial freedom

- Calculators

◦ How Much Do You Need to Retire?

◦ Required Minimum Distribution

◦ How Important is Social Security?

- Questionnaire

◦ Worksheet: Solving the Retirement Puzzle

- White Papers

Withdrawals and Tax Implications

In addition to Social Security benefits, you probably have at least one IRA, 401(k), pension plan or other assets you’re relying on now for income – or counting on later – to finance your retirement years. At this stage you should work with us to maximize the benefits you receive from any withdrawals you are making or plan to make.

Below are some common retirement investments and key considerations for withdrawing your money.

Taxable Accounts

(i.e., brokerage, savings and checking accounts)

Withdrawing from a taxable account first allows more time for tax-free and tax-deferred plans to potentially grow. However it is wise not to exhaust these assets to preserve your future choices.

Tax-Free/Tax-Deferred Plans

(i.e., Tax-Free – Roth IRA; Tax-Deferred – traditional IRA)

You are required to begin withdrawing money from tax-deferred accounts at age 70½, but may consider reinvesting proceeds elsewhere if you do not need the immediate income.

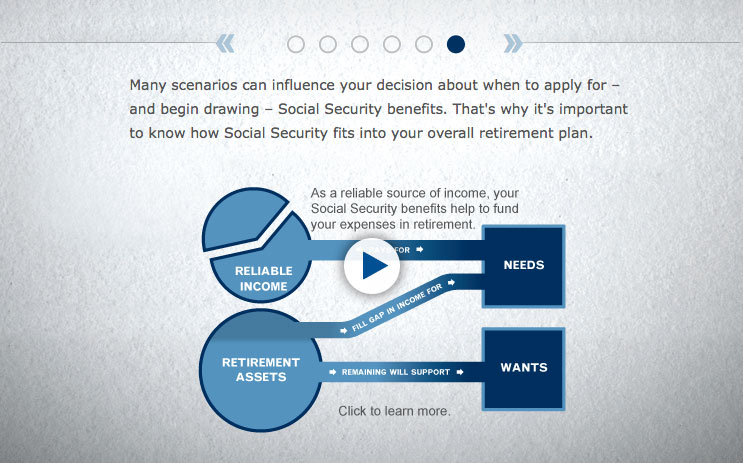

Social Security Benefits

Although you’re entitled to draw Social Security benefits as early as age 62, tapping into your benefits before full retirement age can permanently reduce your benefits. In general, electing to delay your benefits past full retirement age – up to age 70 – will increase the amount you are eligible to receive

The decision around when to begin taking Social Security is a key factor – but there are other important factors to consider:

- Your health and life expectancy

- Your spouse’s or ex-spouse’s benefit

- Whether or not you plan to work after age 62

- Your taxable income or other income sources in retirement

We can help develop a withdrawal strategy that takes all of these considerations into account.

* Investors should consult with a tax advisor to determine the tax implications of the withdrawal strategies.

There is no assurance that any investment strategy will be successful. Investing involves risk and investors may incur a profit or a loss. Past performance is not indicative of future results.

Please note, changes in tax laws or regulations may occur at any time and could substantially impact your situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of Raymond James we are not qualified to render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional.