27 Apr The Sequence of Returns Risk and Your Retirement

Retirement: it’s that long-awaited deep breath, ushering you into relaxation and carefree days spent in your happy place. But unless you’ve been living on the moon, the current state of the economy may have you biting your nails and wondering if it’s something you’ll be able to afford any time soon. One key factor in your retirement strategy you can’t afford to overlook is the Sequence of Returns risk.

What is the Sequence of Returns?

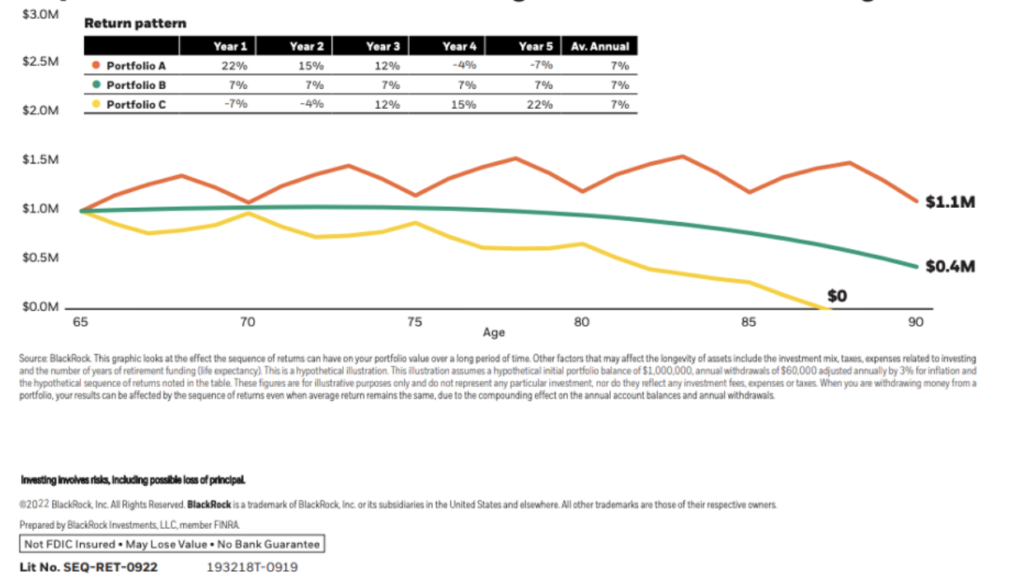

The sequence of returns refers to the order in which investment returns occur over a period of time. When saving for retirement, the sequence of returns is less important because you’re still accumulating wealth; you have time on your side to average out returns. However, during retirement, the sequence of returns can significantly impact income, especially during the five years immediately before and after retiring (this period of time is often called “the fragile decade” for this very reason). This gives us the sequence of returns risk.

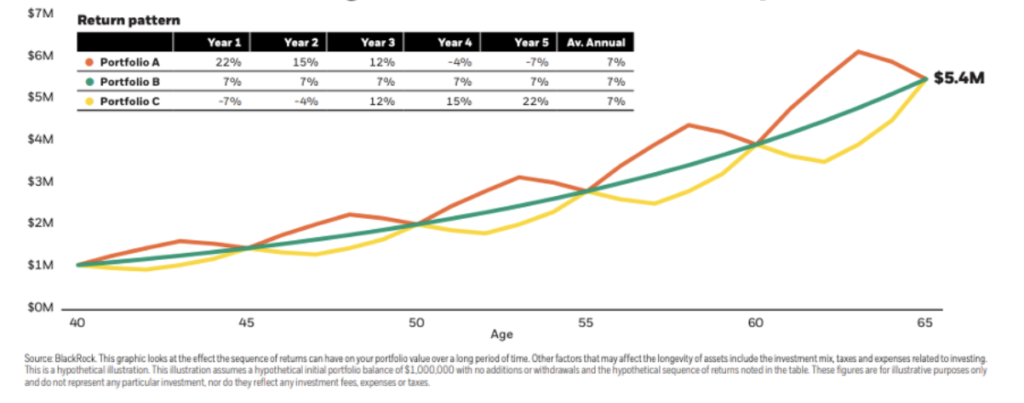

Take a look at these three hypothetical portfolios. Over a 5-year span, even though they experience varying returns, they all end up in the same place. Portfolio A had a 22% return in year one, kicking things off to a great start, while portfolio C was at -7%. But by the end of those five years, both portfolios had identical results. Portfolio C had time to take advantage of higher returns in years four and five, and portfolio A dropped a bit due to low returns later in the timeline.

We all know it’s impossible to predict the market. You could get lucky and see high returns right around your retirement deadline, but luck is never a good financial strategy. A low sequence of returns right before and in the first few years of your retirement can put a hefty dent in your nest egg, leaving you at risk of running out of funds.

Planning Around Unpredictability

So how do you plan a reliable retirement when so much depends on a market that could potentially work against you? You can hedge your bets to protect against a bear market coinciding with your retirement launch in a few ways. Here’s how to help your retirement funds match your longevity:

Save aggressively

You can’t predict the market, but the earlier you start saving, the more you’ll benefit from compounding interest. Build a buffer into your retirement savings so you have some wiggle room, no matter what the economy does. A good strategy to start utilizing now is dollar-cost averaging. By making regular, ongoing investments, you’ll average out at a lower cost per share, all while incorporating a healthy investment habit.

Diversify your portfolio

Diversifying your portfolio across different asset classes, industries, and geographies can lower the sequence of returns risk around your investments. By diversifying, you can minimize the impact of market fluctuations on your portfolio in the same way that lying on your stomach and spreading out your arms reduces the risk of falling through thin ice.

Assess your withdrawal percentage and stick to the plan

Withdrawing as little as possible leaves more of your nest egg to generate income throughout retirement. You’ll need to adjust the amount annually to account for inflation and save enough for retirement initially. How much is enough? Many professionals recommend 80% of your annual income per year of retirement. Remember, there’s no “one size fits all” formula for retirement income. Talk to your advisor to identify what’s right for you.

Opt for an alternate income

Consider incorporating a guaranteed income source into your retirement plan, like an annuity or real estate. Talk to your financial advisor to determine a good strategy for alternate retirement savings and navigating tax implications.

Take advantage of technology

Your advisor should be well-equipped to help you make the wisest plan for your retirement. We use dedicated software that analyzes and factors in the sequence of returns, inflation, and varying markets so that we can provide you with the very best guidance.

The sequence of returns risk may feel like a recipe for sleepless nights, especially for those whose retirement years are just around the corner. But, as always, planning ahead and working with a financial advisor can help you work around these challenges and retire to your happy place.